Exemplary Info About How To Manage Credit Cards

However, there are ways to manage credit, such as changing spending habits or seeking professional support.

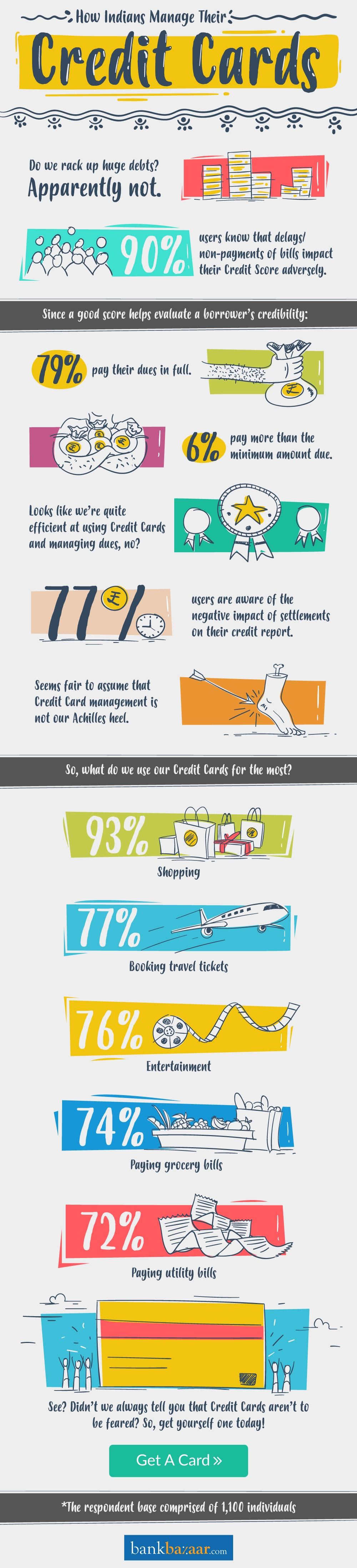

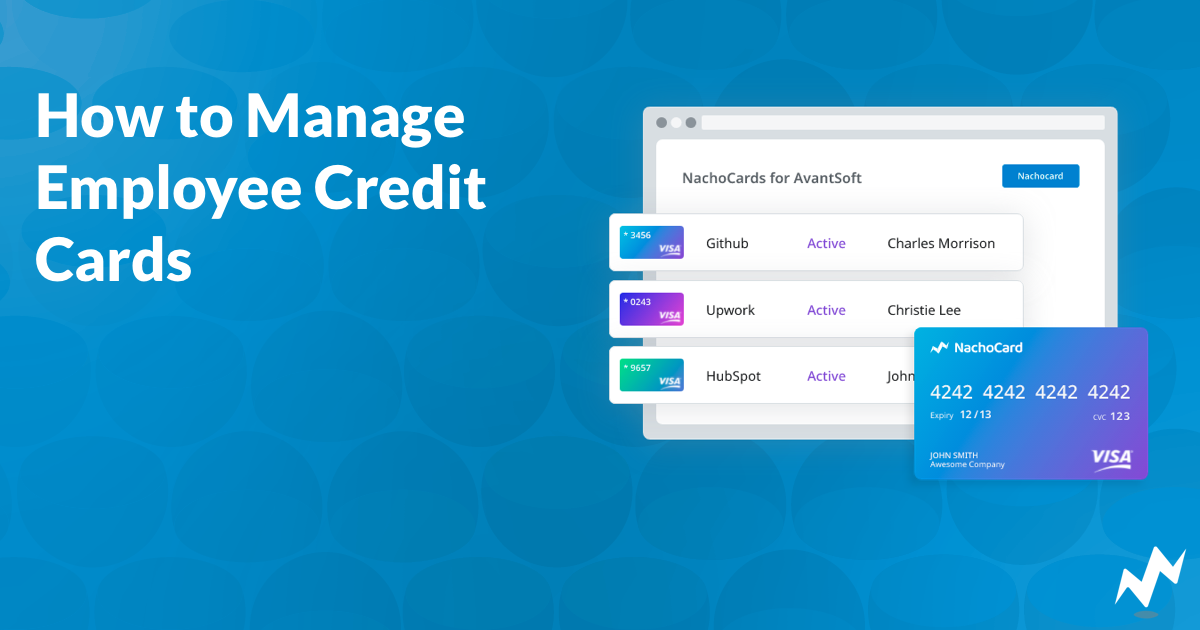

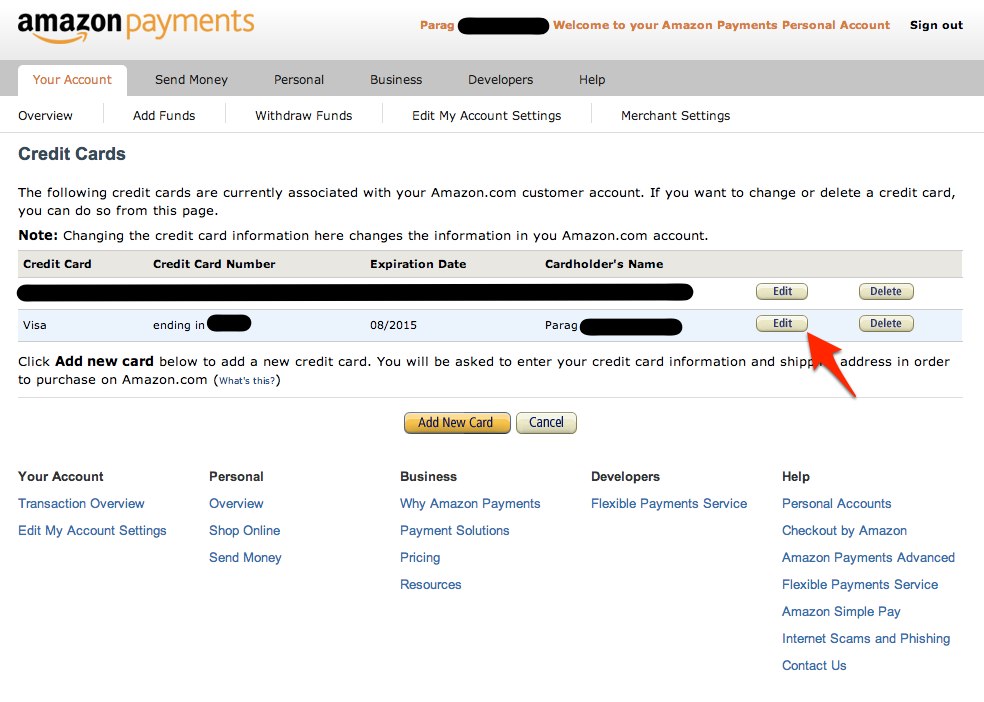

How to manage credit cards. The online payment gateway or credit card processing system software sends the data to the credit card processing service. Here's how i manage them, and how i choose the best card to use to make the most out of my rewards. Understand the different card types.

There’s a premium membership for $24.99 monthly that adds benefits like a credit score comparison among all three credit. Credit card debt management programs, also called debt consolidation programs, can act as an advocate in your debt relief journey. Try to pay more than the minimum each month.

Many americans have trouble keeping track of their cards, but fixing the problem is tricky. That's why it's so important to use your credit card wisely. Consider a balance transfer credit card.

Find the credit card for you. Having a credit card is about as american as apple pie. Best balance transfer credit cards

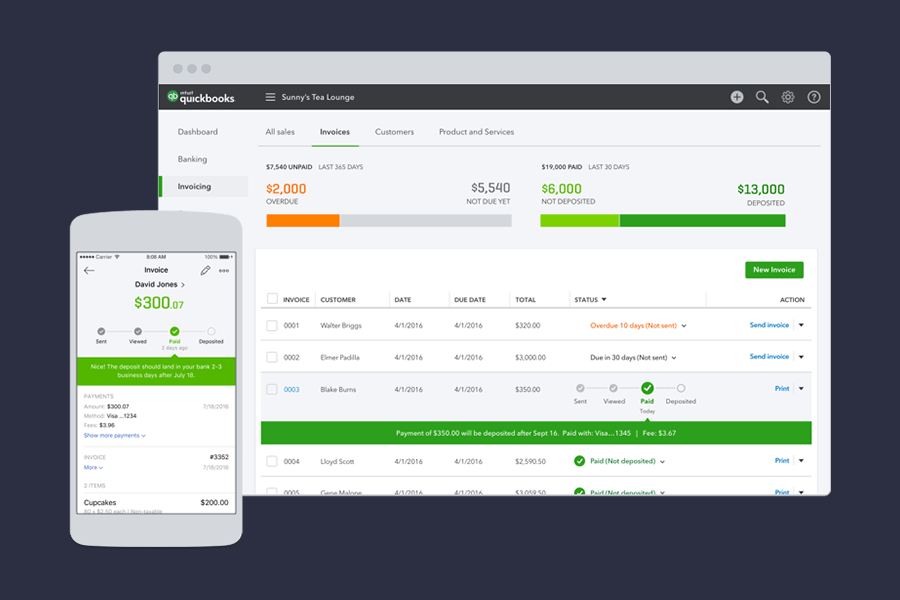

These free apps suit various needs, from paying bills to shrinking debt. Sending data to credit card processing service. Be mindful of the credit limit.

In this comprehensive guide, we will delve into the fundamentals of credit card management, explore effective strategies for credit card use, discuss techniques for managing credit card debt, highlight security and fraud prevention measures, examine the future of credit card use, and explore the role of credit cards in financial planning. Before applying for a dozen of. Services to help you maximize credit card rewards.

Be organized—create a spreadsheet for keeping track of. Managing your credit card debt is key to maintaining healthy finances and a strong credit score. These six tips can help reduce the risk of unwanted charges:

If you've never had a credit card before, you'll need to figure out what credit card to get. Take advantage of all of the benefits. If you leave a revolving balance on your credit card, the interest rate can exponentially increase how much you owe.

Of the three credit bureaus, experian offers the best user experience. Find a card with attractive rates and rewards. Choosing your first card.

Know thy credit cards—this is one of the first rules to keep in mind. Create a budget and stick to it. Don't let credit go to your head.