Outstanding Tips About How To Pay For A House

Yes, it is possible and perfectly legal to purchase a home with cash.

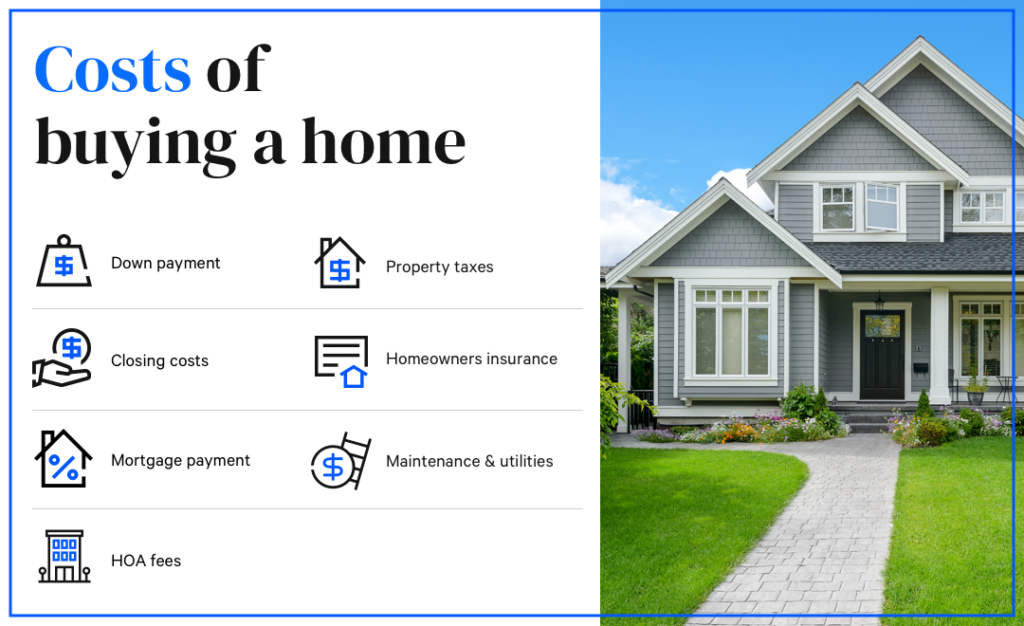

How to pay for a house. This free mortgage tool includes principal and interest, plus estimated taxes,. We’ll look more at how much to save for a down payment later on, but. Should fit comfortably within your budget.

Secure a check for the balance owed after subtracting the earnest. The average home renovation cost ranges from $18,161 to $76,367. Lance hill, is suing amazon over its remake due out this march.

Before you commit to buying a house with cash: First, the buyer makes an offer on the property. Look at your creditworthiness.

A full rundown on what to do & when. How much money do you need to buy a house? You can afford a house up to$229,813 based on your income, a house at this price.

Mortgage payment calculator. This can range anywhere from $0 to 20% of the home’s purchase price. If it’s accepted, you provide an earnest money deposit and sign paperwork to go under contract.

Can you buy a house with cash? Pros of paying cash for a house. Buy your next home with a.

Expect to make a larger down payment for a construction loan than for a traditional mortgage — typically 20% to 25% (versus as little as 3% for a home purchase). Don't assume that cash is better. If someone is selling a property for $250,000, for example,.

Identify what you hope to gain by making a cash purchase. This formula can help you crunch the numbers to see how much house you can afford. Check your credit score to see whether you will be able to borrow to pay for renovations or upgrades, or even to finance unexpected life.

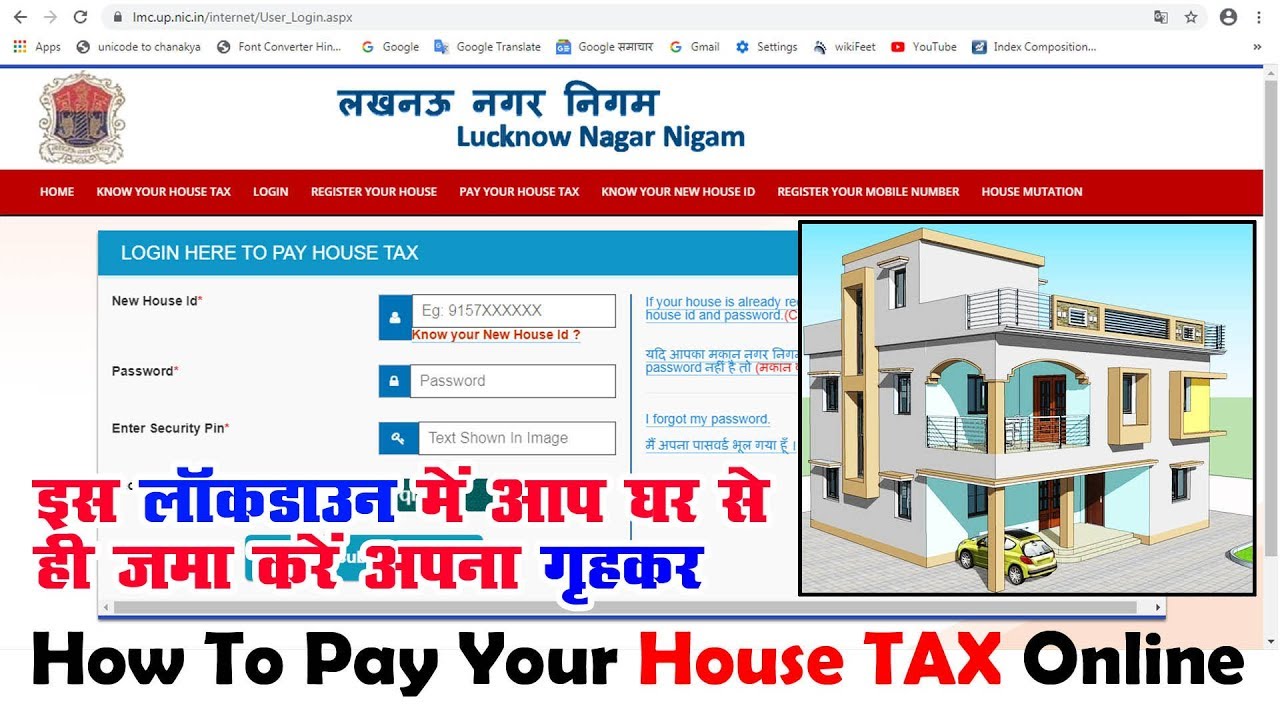

Using our mortgage calculator can take the work out of it for you and help you. Now that you’ve inspected and appraised the house, it’s time to prepare to pay for the home. Buying a home is one of the most.

Rishi sunak refuses to back post office boss who demanded double salary nick read called for his own pay to rise to £830,000, even though he was facing hr. What are the benefits of paying cash for a home? Before you start shopping for homes, you should shop for a mortgage.

![How Much Money Do I Need To Buy a Home? [INFOGRAPHIC]](https://bt-wpstatic.freetls.fastly.net/wp-content/blogs.dir/1363/files/2017/01/Costs-to-buying-a-house1.png)