Simple Info About How To Get A Full Tax Refund

Select the profile icon at the bottom right side of the screen, then tap the.

How to get a full tax refund. Faster filing file up to 2x faster than traditional options.* get your refund, and get on with your life. Use this tool to find out what you need to do if you paid too much on: To check your refund status, you will need your social security number or itin, your filing status and the exact refund amount you are expecting.

Use smartasset's tax return calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. Go to the get refund status page on the irs website, enter your personal data then press submit. Filing status the exact whole dollar amount of your refund use the irs where's my refund tool or the irs2go mobile app to check your refund online.

Can i expect to receive. Make sure you report all income—even savings account interest. Deposit into your checking, savings, or.

*guaranteed by column tax although there isn’t much you can. Download the venmo app on your mobile phone and create an account or sign in. When it’s time to file, have your tax.

Fastest refund possible: That's 2.1% higher than the same period a year ago. As of february 16, the average tax refund is $3,207, the irs said in its latest tax season update.

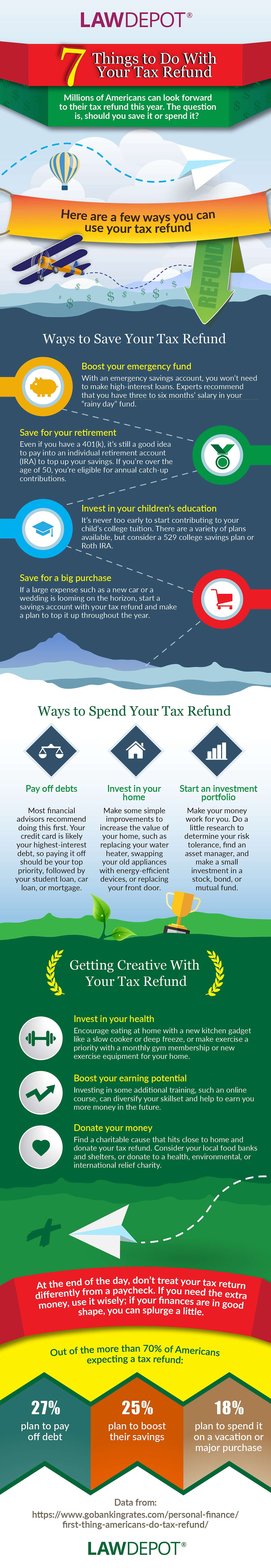

Tax refund time frames will vary. Tax refund time frames will vary. Overview laying the groundwork for a tax refund requires some simple tax planning, a little research and some forethought.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series. This is the fastest and. The irs issues more than 9 out of 10 refunds in less than 21 days.

Federal tax refund delivery time estimations. With the additional $800 colorado tax refund due to most residents this year, everyone is encouraged to file a tax return — and there are several larimer. Has the most up to date information available about your refund.

What you need your social security or individual taxpayer id number (itin) your filing status the exact refund amount on your return check your refund find your. If you're not taken to a page that shows your refund status, you may. You can get your refund by:

I'm counting on my refund for something important. Get your refund, and get on with your life. You may be able to get a tax refund (rebate) if you’ve paid too much tax.