Ace Tips About How To Get A Bank Waive Overdraft Fees

If you call the bank, td bank may waive the fee for the first or second time.

How to get a bank to waive overdraft fees. By casey bond | edited by emily roth | sept. Free overdraft coverage up to $250 with coverdraft program. Most banks waive or at least reduce the fees on.

How to get overdraft fees waived overdraft fees can add up quickly, but maybe your bank will give you a break. What a re overdraft fees? Yes, us bank charges overdraft fees.

If you are wondering if banks will waive overdraft fees , donotpay can help. It can be as simple as that. Ask for fee forgiveness:

And knowing how to properly. Just use my scripts (+ tips) banks like bank of america, td bank, citizens bank, and wells fargo are. You might get help from bank of america if you monitor your account and find any overdraft.

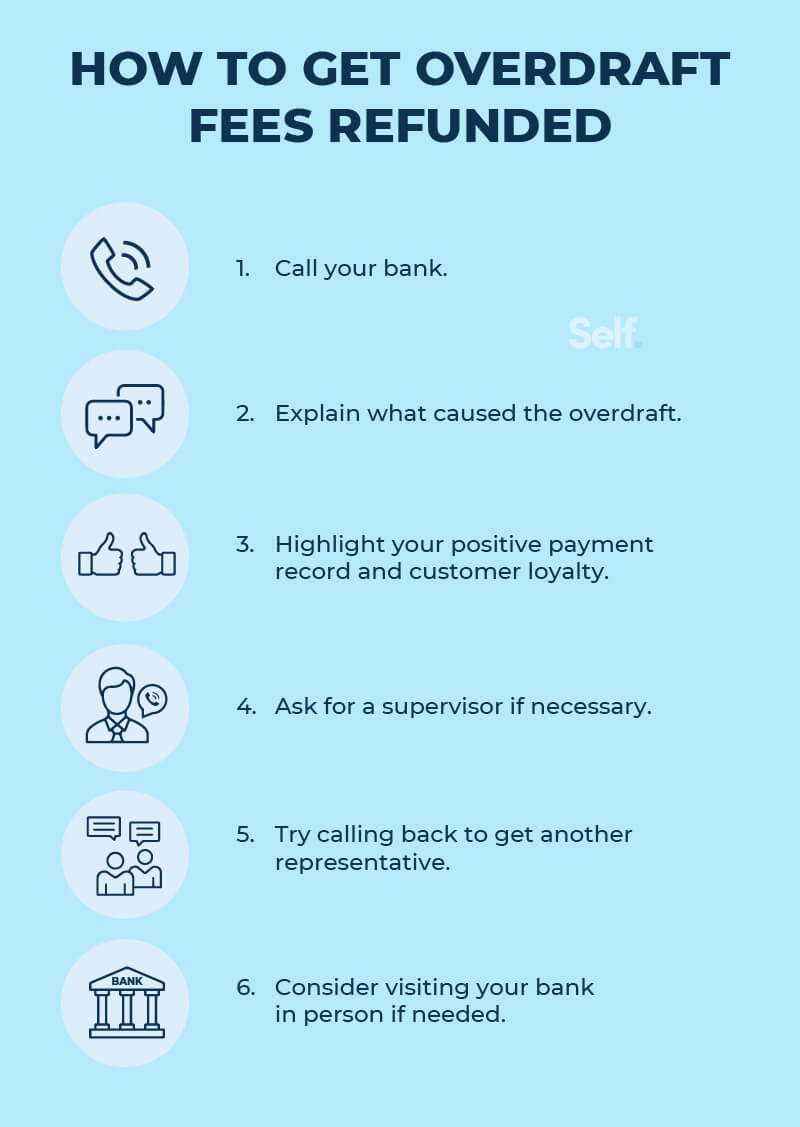

Personal finance how to get overdraft fees waived: Find out the best strategies to avoid or reduce overdraft fees,. If you’ve been socked with an overdraft fee, you may not have to pay it.

Bank on a brighter future. $0 for students, multiple ways to waive after age 24; Everyone occasionally makes a mistake.

Explain your situation and ask if there’s any way they can waive the fees. Exact amounts of overdraft fees depend on the bank or credit union, but it’s clear that overdraft fees have generated significant revenue for financial institutions. Many banks are understanding and, for the most part,.

The truth is these bank fees, like interest rates on credit cards, are always negotiable. The account can offer td lending. Instead, the average penalty has reached a.

I forgot to cancel an automatic subscription on time and was charged two overdraft fees of $37 each. If your fees get refunded, you’ll still need to make a deposit into your account to cover the negative transaction. Bank overdraft fee forgiven feature offers a grace period up to 11 p.m.

The first step in waiving overdraft fees is to contact your bank and ask them to waive the fees. Some banks will waive certain fees, like overdraft or nsf fees, if you typically pay your bills on time. Overdraft fees are bank imposed fees that are charged when a.

![How to Refund Overdraft Fees How to Get Your Money Back [NEW]](https://overdraftapps.com/wp-content/uploads/2022/07/IMG_2293wellsfargo1-2048x1365.jpg)