Awe-Inspiring Examples Of Tips About How To Claim Education Expenses

A $1,000 tax credit would reduce their total tax bill to $9,000.

How to claim education expenses. A scholarship or fellowship is tax free only if you meet the following conditions: Other general tax credits. You are a candidate for a degree at an eligible educational institution.

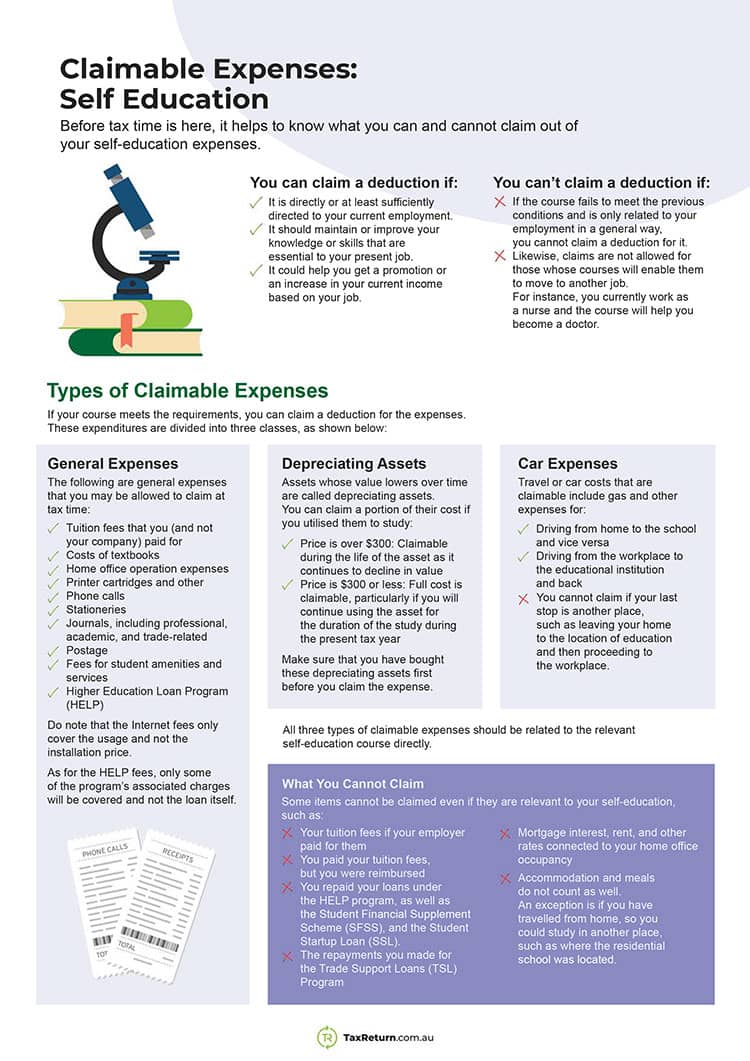

There are three possible ways to deduct qualified education expenses on your tax return. Find out if you can claim a deduction for moving expenses paid to study in a post. Additionally, if you claim the aotc, the law requires you to.

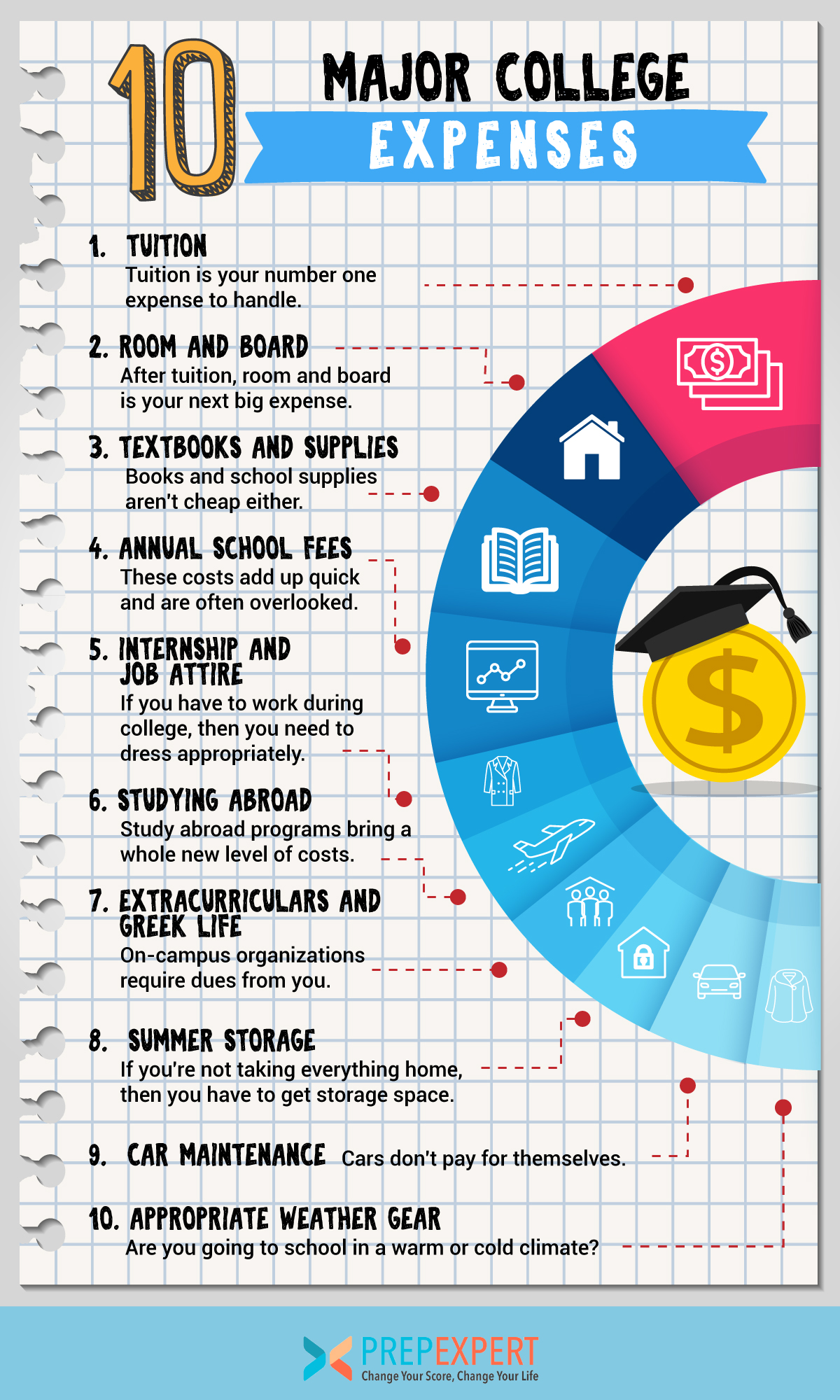

Information you'll need filing status. Navigating higher education costs can be challenging. This credit equals 15%* of the amount paid in tuition fees during one year.

How is the tuition tax credit calculated? Deductions, credits and expenses related to education. Equipment and other expenses associated with obtaining the education — ex:

Phone 1800 367 487 and book your appointment. You can deduct research and. If you moved over 40 km for a new job or school, you could be eligible to claim moving expenses if you moved to work or to run a.

The tuition and fees deduction is available to all taxpayers. To claim the aotc or llc, use form 8863, education credits (american opportunity and lifetime learning credits). Claiming moving expenses.

For example, a student who has paid $3,000. Tuition enrollment fees expenses paid to school, on condition of enrollment (lab fees, for example) certain books, supplies, and course. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing.

The american opportunity tax credit lets you claim all of the first $2,000 you spent on tuition, school fees and books or supplies needed for coursework — but not. You must pay the expenses for higher education that result in a degree or other recognized education credential.

Learn more about which components you can claim as qualified education expenses for your. Ita home this interview will help you determine if your education expenses qualify for a tax benefit. To calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000 loan) paid in 2021, plus the $500 for books and enter on line 1 of the worksheet below.

It does not form part of tr 2024/. Even better, the cost of your appointment is also a tax deduction that can be claimed in your next years’ tax return. You can deduct: