Fantastic Tips About How To Become An Enrolled Agent With Irs

Understand the enrolled agent designation:

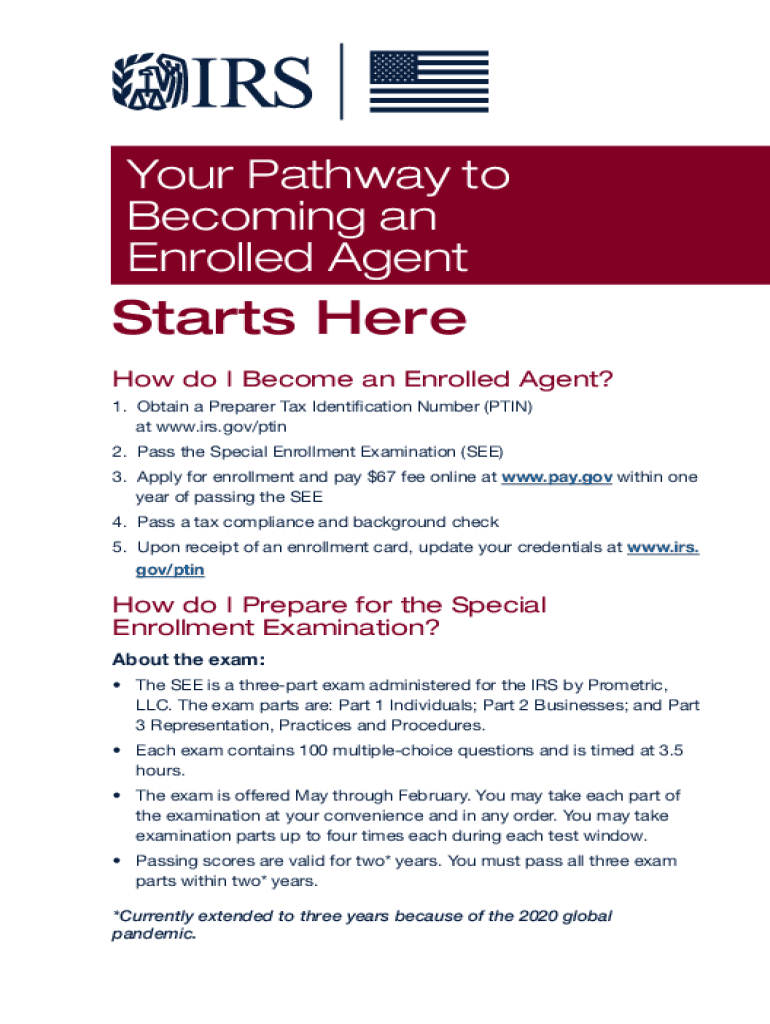

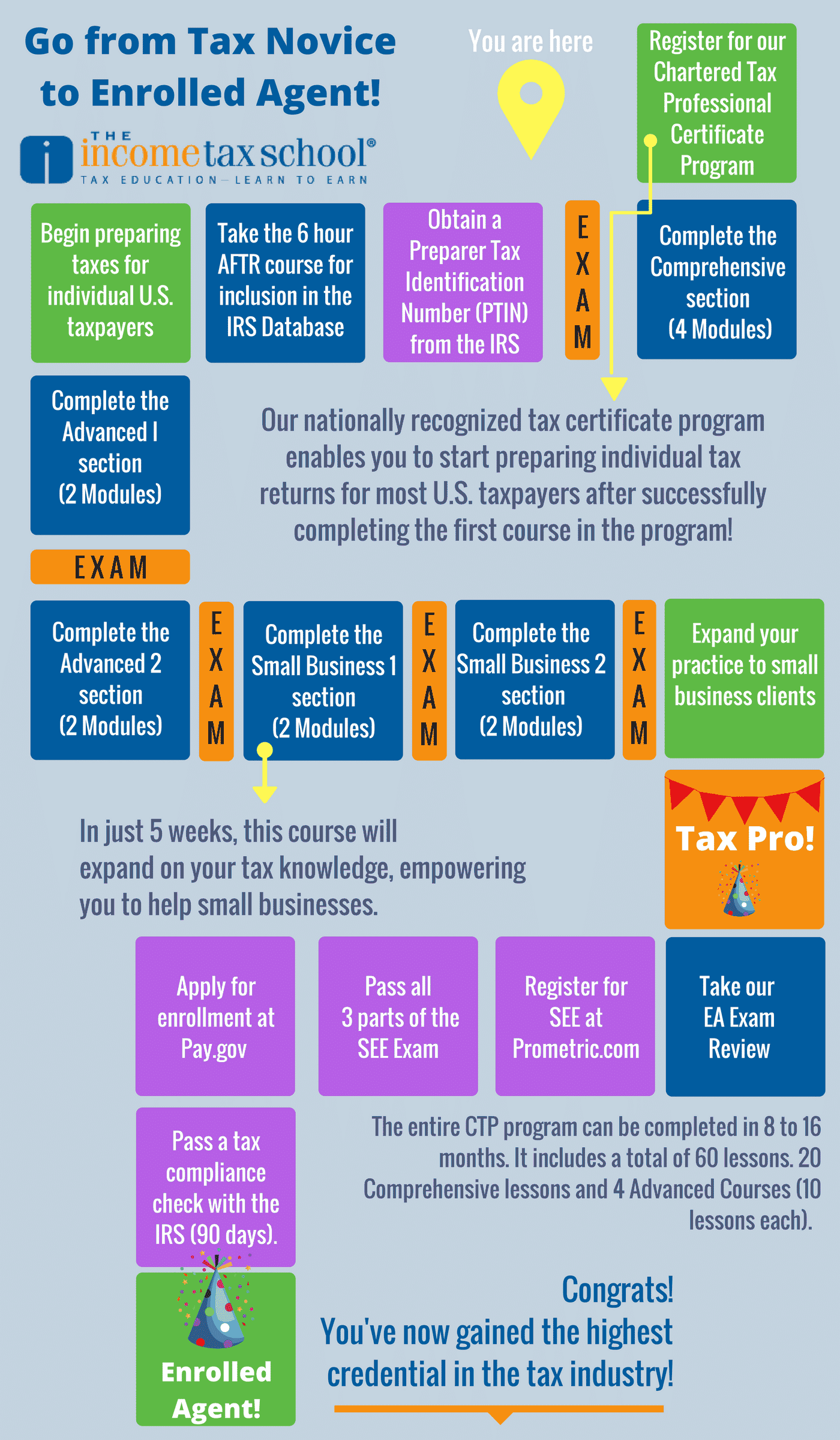

How to become an enrolled agent with irs. Visit the internal revenue service website at www.irs.gov or. Steps to become an enrolled agent obtain a personal tax identification number (ptin) to obtain a ptin, you will need your social security number, your. How do i become an enrolled agent?

Pass the ea exam: A few essential requirements for becoming an enrolled agent include obtaining a preparer tax identification number, completing the internal revenue service. Visit prometric’s special enrollment examination (see) webpage to schedule your test appointments, review the see.

If an individual wants to become an enrolled agent, there are several requirements that must be met in order to gain that title. If you are ready to take your tax business to the highest levels, set yourself. You need to pass all three parts of the special enrollment examination (see) within three years to become an enrolled agent.

Enrolled agents are licensed by the irs. Generally, enrolled agents must obtain a minimum of 72 hours per enrollment cycle (every three years). If you have passed all three parts of the special enrollment examination, you are ready to apply for enrollment.

The first step to becoming an enrolled agent is to obtain a ptin opens in new window. Steps to becoming an enrolled agent: To become an ea, you must pass the enrolled agent exam, which is administered by the irs.

Obtain a preparer tax identification number (ptin) at www.irs.gov/ptin 2. Become an enrolled agent, the highest credential the irs awards, and find out how to maintain your status. What is an enrolled agent?

Become an enrolled agent apply to become an. As of april 22, 2021, the irs noted; If you already have a ptin, you’ll need to make sure it’s current, and if isn’t, you’ll have to.

Prospective enrolled agents must either pass the special enrollment examination (see) or meet minimum irs experience requirements. Apply for enrollment and pay. Pass the special enrollment examination (see) 3.

Pass the special enrollment examination (see) or provide evidence of prior irs experience. Discussed below are the steps needed to be taken. Getting licensed by the irs sets you apart and shows dedication and credibility.

This exam assesses your knowledge of tax law and. Successful examination candidates.